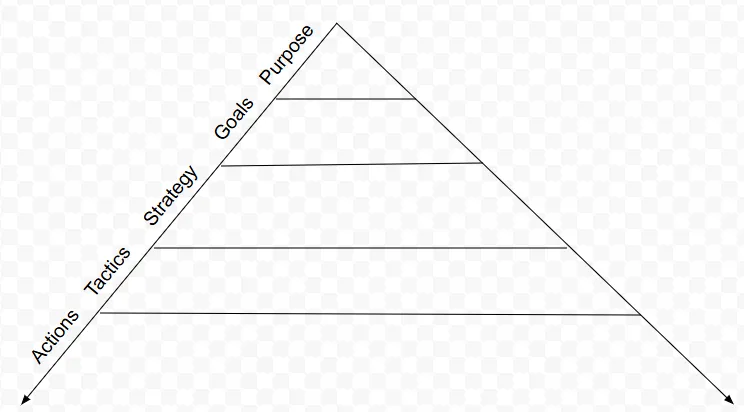

NFA GRS Purpose Framework

This article is not financial advice it is intended for general use and I have no idea about your systems or personal circumstances. Feel free to use the plans and framework to evaluate your decisions but I have no idea why you would.

What is the purpose of the session, setting a framework to achieve your goals and purpose.

Purpose sets the stage a why. "If you have a why you can survive almost any how" attributed to Nietzsche.

Goals for what purpose? Goals without measurement and timelines are dreams. When my wife and I set our 5-year plans and goals we achieved all of them save "writing a book" which I put on the same list as my wife put have children and the children have taken over.

Strategy is the systems (mental models) of accountability and how you will meet the goals. "An idiot with a plan (strategy) will beat a genius without one" -Warren Buffet. It is better to have a system than it is to be smart you can evaluate systems and figure out the gaps, holes, stress points and failures without you knowing where to look.

Tactics in my mind is learning what others have done to achieve their strategy, goals and plan. Some of them are self-evident, incentivised by the government with money or tax advantages. What tools are there it this a profession in disguise (popularly called a side hustle which is a profession you don't get paid for so the books look more profitable). Remember if you plan to become wealthy most governments will want to be involved so deciding on a tax strategy and tactics is essential.

Actions this is where the rubber meets the road, you implement automated systems to make contributions right from your paycheck or balance sheet to retirement, college, rainy day fund, 90 days FU money but money is fungible and you can defer or pillage from some of these funds if you have changing needs. This should include when to meet with a tax advisor or become more informed about taxes, financial instruments etc...

Any of the sites below are a quick trip back to someone doing it for you if you think you are too dumb but I doubt you are.

For the very basics sorted why to have a savings account, how to get a 90-day cash buffer built up and why to be afraid of debt and credit cards this is a nice site.

Petrified no idea how to start. Do you already have some unhealthy money habits or ideas?

Hidden Brain’s Money 2.0 series May 2022: Podcast series on why we fail at money. Recently he interviewed Richard Thaler a behavioural economist. “Behavioural Economics does not say that people are stupid but that the world is hard” – R. Thaler

TheHappySaver.com Podcast series Really into the FIRE movement Financial Independence Retire Early

LOOT Live On your Own Terms is another nice starting place this speaks to the need for AUTONOMY

NerdWallet debt management solutions podcast

GET SOME TAX HELP BEFORE YOU GO BIG, good tax advice is worth more than any financial advice it is almost everyone’s largest expense.